Oftentimes there are insurance terms that people vaguely understand. And they feel a little embarrassed to ask for help with this. So, let’s take it back to the basics. Consider this a simple course in Health Insurance 101 with the end goal being to bring clarity and understanding to these terms.

Your DEDUCTIBLE is the amount you pay for covered health care services before your insurance plan starts to pay. For example, if you have a $2,000 annual deductible, you’ll need to pay the first $2000 in medical costs before your plans helps to pay. Costs that typically count toward your deductible include hospitalization, surgery, lab tests, MRI & CT scans, anesthesia, and doctor/therapist visits not covered by a copay.

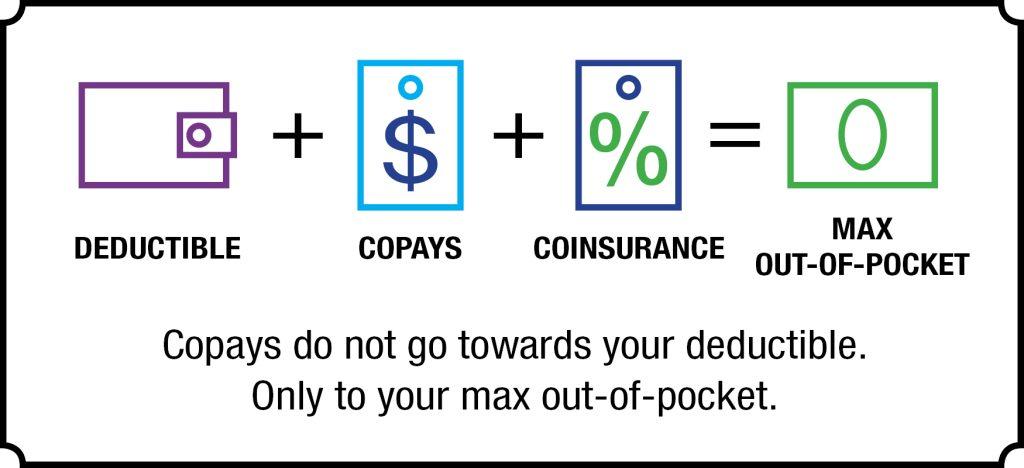

A COPAY is a flat fee that you pay at the time of visit each time you go to the doctor or fill a prescription. Copays cover your cost of a doctor’s appointment or medication. Not all plans have copays.

COINSURANCE is the percentage of costs you pay (for example 20%) after you’ve met your deductible. One of the most common coinsurance breakdowns is 80/20 where the insurance company pays 80% and you pay 20%.

MAXIMUN OUT-OF-POCKET is the most you pay for medical services in a covered year. Your deductible, copays and coinsurance all count towards meeting the Maximum Out-of-Pocket. Once this is met, the insurance company pays all claims for the rest of the year.

A HIGH DEDUCTIBLE HEALTH PLAN (HDHP) is also frequently referred to as an HSA. These plans have higher deductibles and plan features that conform to federal guidelines. HDHPs cover certain preventive care before the deductible is met, but under the guidelines no other services can be paid for by the health plan until the deductible has been met. This means that HDHPs can not have copays for office visits or prescriptions prior to the deductible being met. Instead, the insured will pay the full cost of these services and that cost will be applied to the deductible.

HDHPs are the only plans that allow an enrollee to contribute to a Health Savings Account (HSA). HSAs are savings accounts that let you set aside money on a pre-tax basis to pay for medical expenses. The money in HSA accounts can accumulate year over year and be a nice savings tool. If we’re being specific, the HDHP is the insurance plan and the HSA is the bank account but most people refer to both as an HSA.

Beyond the basics, there is much more to learn about how health insurance works. Our ComPro Team is here to provide help with this and to answer your questions. Just give us a call at 402-488-5100. ComPro offers health insurance plans for Employee Benefits, Individual & Family and Medicare. We are your trusted, local resource for health insurance! For more info, visit our website at www.comproins.com.

By Kayla Northup – Location Manager, MGA, Agent